Buying a home in New Jersey is exciting, but it also means dealing with one of the highest property tax burdens in the country. If you’re a prospective buyer, understanding how property taxes work, what your obligations will be, and potential relief programs can make a meaningful difference in your homeownership costs. In this blog, we’ll walk through the essential things you need to know about property taxes in New Jersey: how they’re calculated, when they’re due, how to appeal assessments, available exemptions or credits, and how taxes factor into your closing costs and long-term budgeting.

Why Property Taxes Matter to Buyers in New Jersey

Before diving into specifics, it’s important to recognize why property taxes are such a key factor in the New Jersey real estate market:

- High tax burden: New Jersey’s effective property tax rate is among the highest in the nation. Depending on county and municipality, rates often exceed 2 % of a home’s value annually.

- Impact on affordability: Even if your mortgage payments are manageable, high property taxes can make your monthly outlay much higher and erode your buying power.

- Volatility & revaluations: Assessments and tax rates may change over time, so what you pay in Year 1 may not hold constant.

- Closing & recurring costs: Property taxes influence your closing costs, escrow setup, and long-term budget.

Because of all these, a savvy buyer will go into the transaction with a clear understanding of property tax mechanics, key dates, and relief options.

How Property Taxes Are Calculated in New Jersey

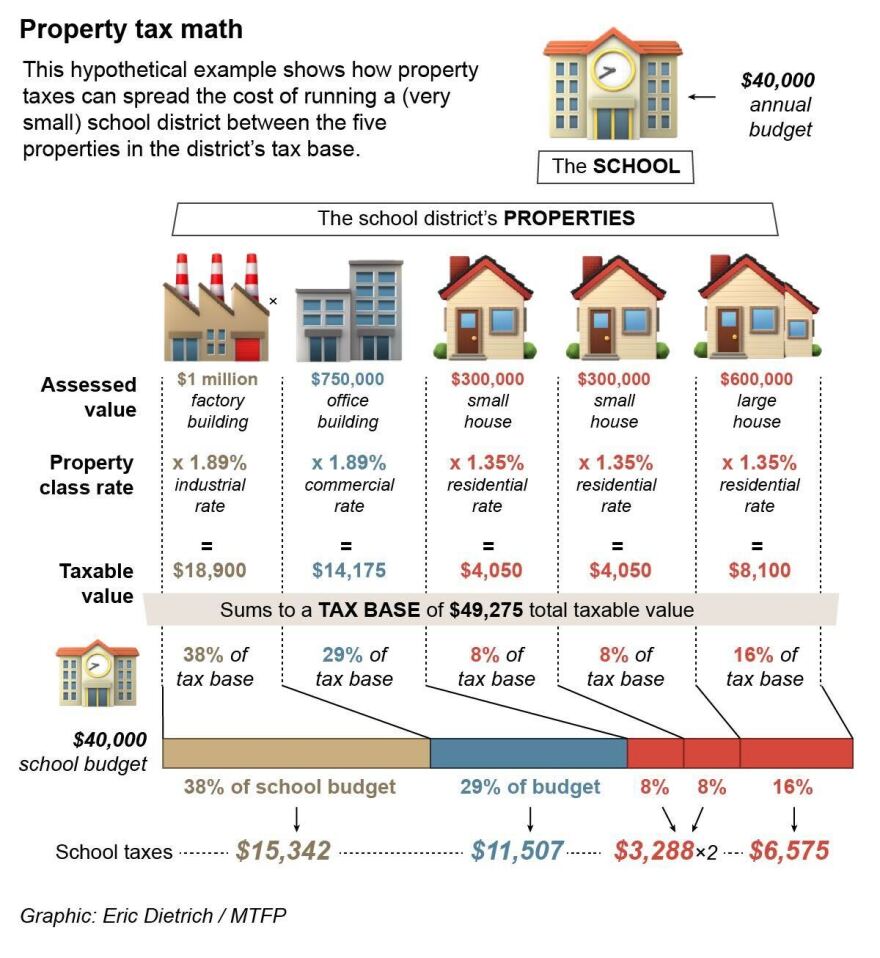

Ad Valorem Basis

Property taxes in New Jersey are “ad valorem” taxes — meaning they are based on the value of the property. NJ.gov+1 In other words:

Assessed Value × Tax Rate = Property Tax Bill

However, the process behind “assessed value” and “tax rate” has nuance.

Assessment & Equalization

Each municipality has a municipal assessor (or a shared assessor) who assigns values to each parcel of real property. princetonnj.gov+1 The goal is that assessments should reflect “full and fair market value” (also called “true value”).

But because assessment levels may drift from market conditions, New Jersey applies equalization ratios (set by county or state tax boards) so that all properties in a taxing district share the tax burden equitably. SmartAsset+1 This ensures one property isn’t unfairly over- or under-assessed relative to neighbors.

Taxable Value & Exemptions

Once assessed, some properties may have exemptions or deductions (for example for disabled veterans, seniors, or historic property status). These reduce the taxable base.

Tax Rates (Millage / Levies)

Each year, taxing bodies, including municipalities, school districts, counties, and special districts (e.g. libraries, fire, open space) adopt budgets and set their tax levies. princetonnj.gov+1 The total tax rate (sometimes expressed in dollars per $100 or “mills”) is applied to the taxable assessed value. princetonnj.gov+1

Because multiple jurisdictions levy taxes, even two homes with identical assessed values in different municipalities may have widely different effective tax bills.

Effective Tax Rate & Comparisons

Rather than relying solely on assessed rate, many buyers look at the effective tax rate — the actual tax paid as a percentage of market value. In New Jersey, average effective rates typically range between ~1.8% to 2.5%, depending on location. SmartAsset+2Clever Real Estate+2

For instance, SmartAsset estimates New Jersey’s average effective property tax rate is around 2.33%. SmartAsset Meanwhile, other sources cite ~1.99%, reflecting variation by county. Clever Real Estate

What You’ll Owe & When (Tax Payment Timing)

Tax Bill Cycle & Installments

Unlike some states that issue one annual tax bill, New Jersey property taxes are typically paid in four quarterly installments:

- February 1

- May 1

- August 1

- November 1 princetonnj.gov+1

If you own the home via a mortgage with escrow, your lender will often collect a portion monthly and pay the tax installments on your behalf.

Estimated vs. Final Bills

In cases where local budgets or tax rates are not finalized in time, the municipality may send estimated tax bills for early quarters, then “true-up” with the final bill once parameters are set. princetonnj.gov

What Happens If You Don’t Pay?

If taxes are not paid by the November due date, the municipality can impose a tax lien on your property. princetonnj.gov Interest accrues: 8% on the first $1,500 delinquent, then 18% on the balance and under certain circumstances penalties may raise rates even further. princetonnj.gov

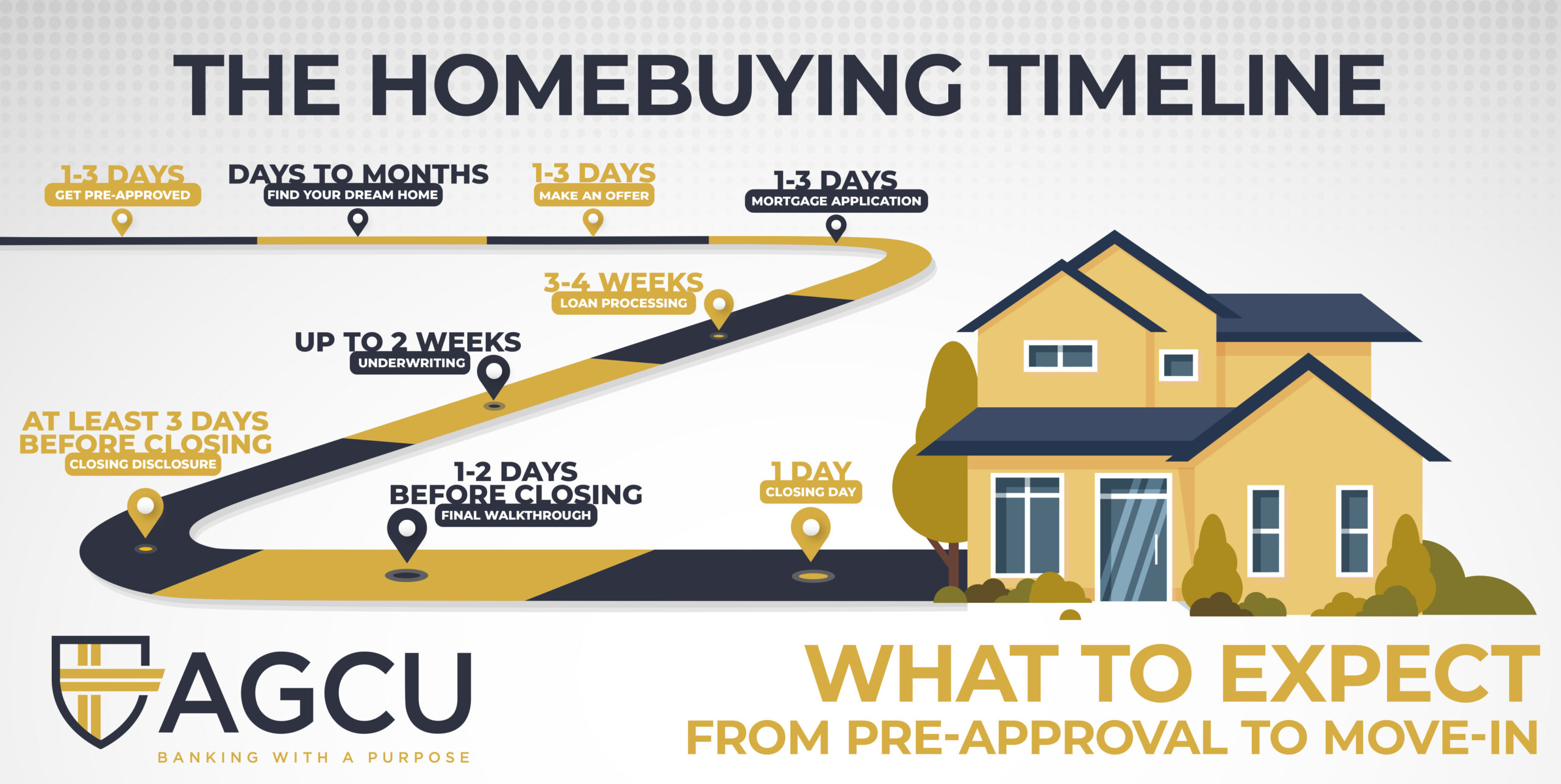

What Buyers Should Do Pre-Purchase

As a buyer (or prospective buyer), here are key steps and considerations around property taxes:

1. Review the Property’s Tax History

Ask your agent or seller for past tax bills (preferably 3–5 years). See how assessments and tax rates have evolved. Look for trends: dramatic jumps may suggest revaluation or neighborhood changes.

2. Evaluate Comparable Homes

Compare the property’s assessment ratio and effective tax rate with similar nearby homes in the same municipality. If your property seems unusually high, there may be room for appeal later.

3. Budget for Escrow & Monthly Carrying Costs

Your mortgage payment should anticipate property taxes. Ask your lender to provide an estimate of monthly escrow deposits for the tax payments.

4. Consider Future Assessment Increases

Even if your first-year tax bill seems manageable, anticipate reassessments or upward pressure on municipal or school budgets. A buffer is wise.

5. Ask About Local Exemptions & Incentives

Some municipalities offer local property tax relief programs, or exemptions for veterans, seniors, or disabled homeowners. Your real estate agent or municipal tax office can guide you.

6. Confirm Who Pays During Closing

In many transactions, property taxes are prorated between buyer and seller. Depending on closing date, the seller may owe a portion. Review the settlement statement closely.

Transfer Taxes, Fees & Closing Costs

Buying a home involves more than just recurring property taxes. Here’s what to expect around closing time:

Realty Transfer Fee (RTF)

In New Jersey, when title transfers by deed, the seller typically pays a Realty Transfer Fee based on the sale price. NJ.gov+1 The fee structure is tiered: higher-priced properties pay higher marginal rates. NJ.gov

For purchases exceeding $1 million, an additional 1% transfer tax may apply. NJ.gov

Some municipalities or counties may also impose local transfer taxes or recording fees, so check your specific area. Clever Real Estate

GIT/REP (Gross Income Tax / Required Estimated Payment)

Sellers in New Jersey must file a GIT/REP form at closing, and in some cases make an estimated income tax payment when the deed is recorded. NJ.gov+1

- Resident sellers can often claim exemption using GIT/REP-3 if no estimated tax payment is required. NJ.gov

- Nonresident sellers may need to pay 2% of consideration or 8.97% of net gain at closing unless exempt. NJ.gov+1

This is less relevant to the buyer, but it’s part of the transaction dynamics and closing logistics.

Prorations

Taxes are usually prorated so the seller pays up to the closing date, and the buyer pays for the remainder of the fiscal or tax period. Confirm the prorated amounts on the closing disclosure.

Frequently Asked Questions About Property Taxes in New Jersey

1. How are property taxes calculated in New Jersey?

Property taxes in New Jersey are based on your home’s assessed value multiplied by the local tax rate. Each municipality sets its rate based on budgets for schools, counties, and municipal services. Your annual bill reflects both your home’s value and the tax rate where you live.

2. What is the average property tax rate in New Jersey?

New Jersey has one of the highest property tax rates in the U.S., with an average effective rate of about 2.2%–2.3% of a home’s value. Actual rates vary by county and municipality.

3. When are property taxes due in New Jersey?

Property taxes are due quarterly:

- February 1

- May 1

- August 1

- November 1

Many homeowners pay monthly into an escrow account managed by their mortgage lender.

4. Do first-time homebuyers in New Jersey get any property tax benefits?

New Jersey doesn’t offer a statewide property tax break just for first-time buyers. However, programs like the Homestead Benefit, Senior Freeze, and Veterans’ exemptions may reduce taxes if you qualify.

5. Are property taxes included in my mortgage payment?

If your lender requires an escrow account, property taxes will be added to your monthly mortgage payment. The lender then pays your taxes directly to the municipality on your behalf.

6. What happens if I don’t pay property taxes in New Jersey?

Unpaid property taxes become a lien on your home. Municipalities can charge interest (8% on the first $1,500 overdue, and up to 18% beyond that). If unpaid for too long, your property may be subject to a tax lien sale.

7. Can I appeal my property tax assessment?

Yes. If you believe your property is assessed higher than comparable homes, you can file an appeal with your county board of taxation. You’ll need evidence such as appraisals or comparable recent sales. Appeals are typically due by April 1 each year.

Leave a Reply